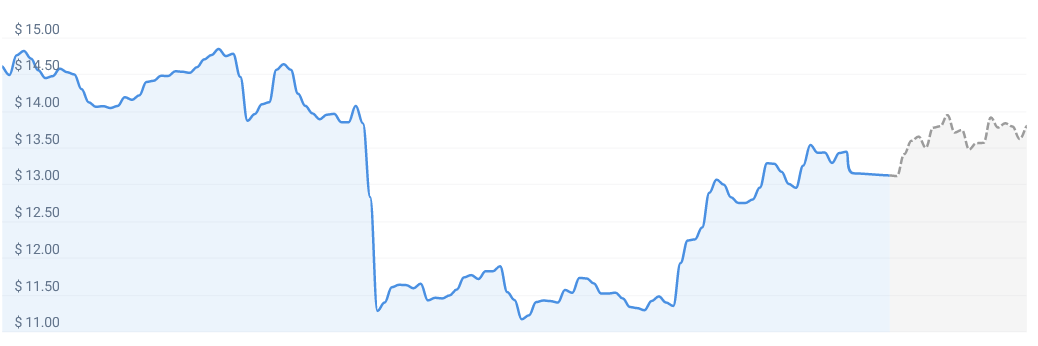

In the vast universe of cryptocurrencies, certain coins grab attention due to their unique propositions and performance. One such promising digital asset is Avalanche, a high-speed, low-cost platform for decentralized applications and custom blockchain networks. Based on our current market forecast, the value of Avalanche is predicted to rise by approximately 4.15%, potentially reaching $13.81 by July 2, 2023. This prediction is influenced by various factors including the trading volumes, price trends, and overall market momentum.

An essential component in understanding the market dynamics of a cryptocurrency is the overall market sentiment. Presently, our technical indicators suggest a bearish sentiment towards Avalanche. This sentiment, informed by an amalgamation of various market indicators, shows that investors are currently cautious about Avalanche.

Interestingly, the Fear & Greed Index, a popular metric to gauge the market’s emotional state, currently reads 59 for Avalanche. This value falls in the ‘Greed’ category, indicating a bullish sentiment, contradicting the bearish sentiment from our technical indicators. This index combines diverse data points like market volatility, momentum, social media sentiment, and surveys to create a score between 0 and 100. A score above 50 suggests a bullish market sentiment, indicating that investors, despite the bearish sentiment, still have faith in the coin’s potential.

Evaluating Avalanche’s recent performance, the digital currency has registered 50% green days over the last month. This means that the coin’s closing price was higher than its opening price on 15 of the past 30 days, displaying resilience amidst the inherent volatility of the crypto markets.

Indeed, Avalanche has experienced a considerable price volatility of 9.71% over the last month. Such volatility can be a deterrent for risk-averse investors but can also offer profitable opportunities for risk-tolerant individuals. For instance, seasoned traders may leverage this volatility for short-term gains, while long-term believers in Avalanche might use these price swings to acquire more coins at lower prices.

However, based on our current Avalanche forecast, we advise that now may not be the most opportune time to buy Avalanche. This caution is primarily due to the prevailing bearish sentiment. Nevertheless, every investment advice should be taken as a piece of a larger puzzle, not replacing personalized financial advice. Investing in cryptocurrencies, including Avalanche, involves certain risks, and it’s vital to undertake thorough research before making any investment decisions.

In summary, Avalanche presents an intriguing paradox in the cryptocurrency space. Despite a bearish sentiment, the projected price increase and a bullish Fear & Greed Index suggest a complex, dynamic market environment. The upcoming period might be less favorable for buying Avalanche, yet, as is characteristic of the crypto market, the situation could change rapidly with evolving market conditions.

As we continue to monitor the evolution of Avalanche and other digital assets, we remain dedicated to offering you insightful, data-driven analysis. The world of cryptocurrencies can be exciting and rewarding, yet complex to navigate. Our goal is to make this journey simpler and more comprehensible, irrespective of whether you’re an experienced investor or just starting your crypto adventure.